Channel Integration Platform

| Project Background

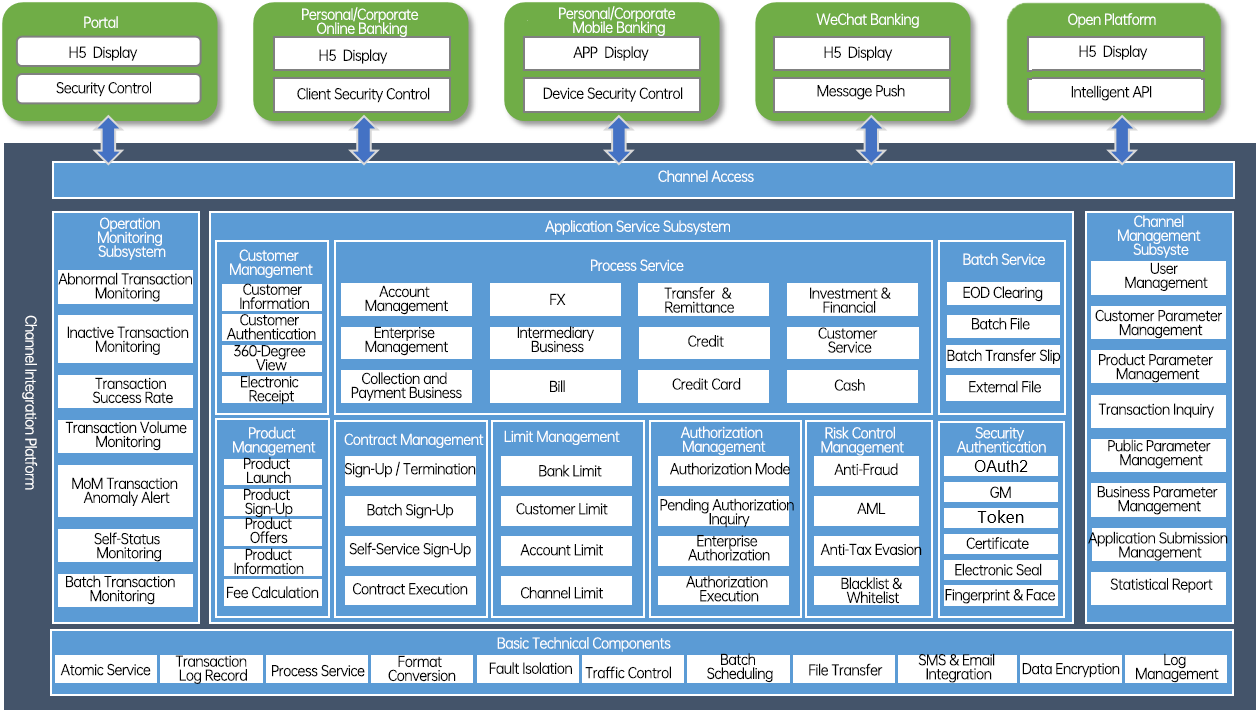

The platform aims to establish unified data standards and service specifications across all channels, integrating processes and information to reduce overall maintenance and development costs. It encompasses electronic channels, manual channels, self-service channels, and external channels, serving as a backend access system for all channel types. The platform enables unified transmission of omnichannel transaction information, consolidated distribution of transaction data, centralized security authentication and authorization, standardized system access, unified information models and transformation, consistent process management, and streamlined monitoring.

This solution supports rapid deployment of new services, single-development multi-channel product releases, proactive product marketing, delivery of consistent customer information, and personalized multi-channel services. By unifying all channel access, it eliminates differences in communication methods and message formats between channels and systems, integrates business logic across channels, and provides centralized authentication and security management for institutions and personnel. Ultimately, it delivers a consistent customer experience across diverse service channels and standardizes channel service management.

| stomer Pain Points

1. Independent Channel Systems: Banking channels are built and operated in isolation, with separate business functions and customer data, leading to significant redundancy and inefficiency. This results in:

● Inconsistent business processes across channels, increasing the cost and time required for new service launches and upgrades.

● Data silos where each system defines its own data standards, hindering scalability and limiting the potential value of data assets.

● Fragmented business processes and customer data, making cross-channel collaboration and marketing efforts extremely difficult.

● Cumbersome backend maintenance, requiring operational staff to perform extensive repetitive tasks.

2. Technical Architecture Challenges: Widely varying technical frameworks across channel systems lead to high maintenance costs. These systems struggle to support high-concurrency traffic, ensure high availability, and adapt to evolving technological trends.

| Solution Overview

1. The Channel Integration Platform adopts a "thin front-end, thick middle-office" architectural model:

● Front-end systems are lightweight, flexible, and highly adaptable, focusing exclusively on customer experience and security.

● Business middle-office consolidates robust capabilities, providing 11 categories encompassing over 1,000 business service processes, enabling full-channel business and data sharing, as well as cross-channel collaboration and interaction.

2. Standardized Business Processes via Middle Office

The business middle office establishes unified and standardized business processes, offering service governance and agile development capabilities to enable rapid iteration of business functions.

3. Unified Customer-Account-User Center System

The business middle office delivers an integrated triple-center framework encompassing customer, account, and user management, featuring:

● Centralized authorization controls

● Unified security authentication protocols

● Consolidated product information repository

● Standardized limit management

● Harmonized risk control mechanisms

The platform enables intelligent data analytics and combines behavior tracking, governance, risk management, and marketing functionalities into a dual-cycle business data engine, supporting continuous optimization and real-time decision-making.

4. Unified Omnichannel Internal Management

The platform provides comprehensive internal management capabilities across all bank channels, enabling:

● Centralized parameter maintenance

● Unified process approval mechanisms

● Consolidated business publishing

● Standardized information management

● Integrated access control and permissions

● Cross-channel business query functionality

● Consolidated reporting and analytics

5. Future-Ready Financial Tech Architecture

As a channel middle platform, the Channel Integration Platform adopts a distributed container cloud architecture aligned with fintech evolution. Built on fully open-source SPRING BOOT/SPRING CLOUD frameworks, it delivers:

● Elastic scaling capabilities

● Reactive service support

● Centralized service registry

● Service publishing/orchestration

● Advanced service governance

● API gateway integration

● Open service platform functionality

6. Full-Cycle DevOps and Monitoring

The platform provides DevOps agile development tools and monitoring/operations capabilities covering the entire project lifecycle, supporting efficient execution across requirements, design, development, deployment, and operations phases.

7. Distributed Infrastructure & Deployment Capabilities

The platform provides distributed database solutions and various distributed middleware components, enabling applications to support dual-region three-data-center deployment architectures for enhanced disaster recovery and high availability.