International Settlement System

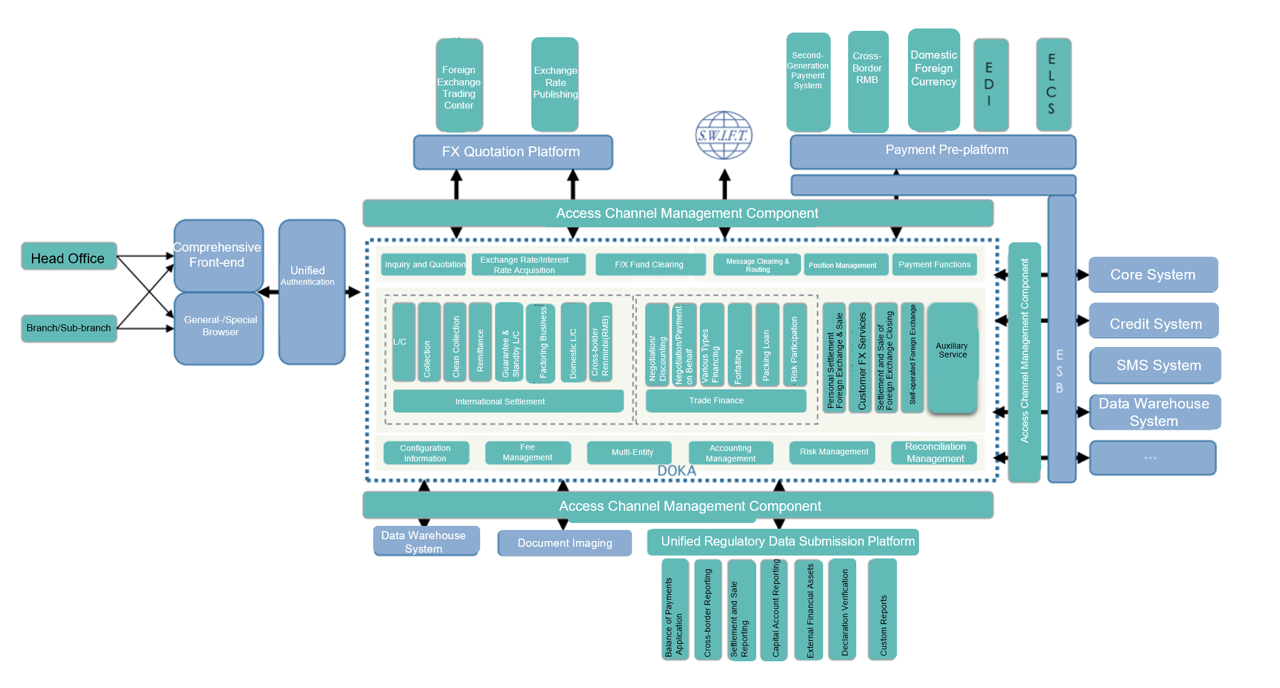

Brilliance Technology's International Settlement System not only handles traditional settlement and trade finance operations, but through continuous innovation and over two decades of industry expertise, has developed a comprehensive business solution centered around international settlement. This includes a unified regulatory reporting platform, access channel management components, an international payment gateway, an electronic letter of credit system, and a blacklist system.

With more than 20 banks across China utilizing our international settlement solutions, we have achieved multiple industry firsts in the domestic market.

1. Deployed a unified global settlement system for a major state-owned bank—China's first internationally centralized solution for international settlement systems—enabling seamless cross-border operations across all branches worldwide.

2. Implemented a documentary center solution for a leading joint-stock commercial bank, pioneering China's first multi-layer structured international settlement system. The same system was adopted by its overseas branches, with plans to integrate a unified overseas international business platform supporting strategic expansion to 10 overseas branches over the next decade.

3. In a large-scale bank's international settlement system project, the first truly multi-entity solution was implemented, which was later applied to multiple provincial rural credit cooperatives international settlement projects.

4. Created a comprehensive payment platform for a large state-owned bank, supporting SWIFT, domestic/foreign currency payments, cross-border RMB messaging, PBOC electronic letters of credit, Western Union, MasterCard, and other channels. The system enables end-to-end management of message sending/receiving, reconciliation, clearing, inquiries, and position management.

5. Achieved direct bank-enterprise connectivity for international settlement systems at a major central state-owned enterprise, streamlining financial operations and enhancing transactional efficiency.