?| Product Overview

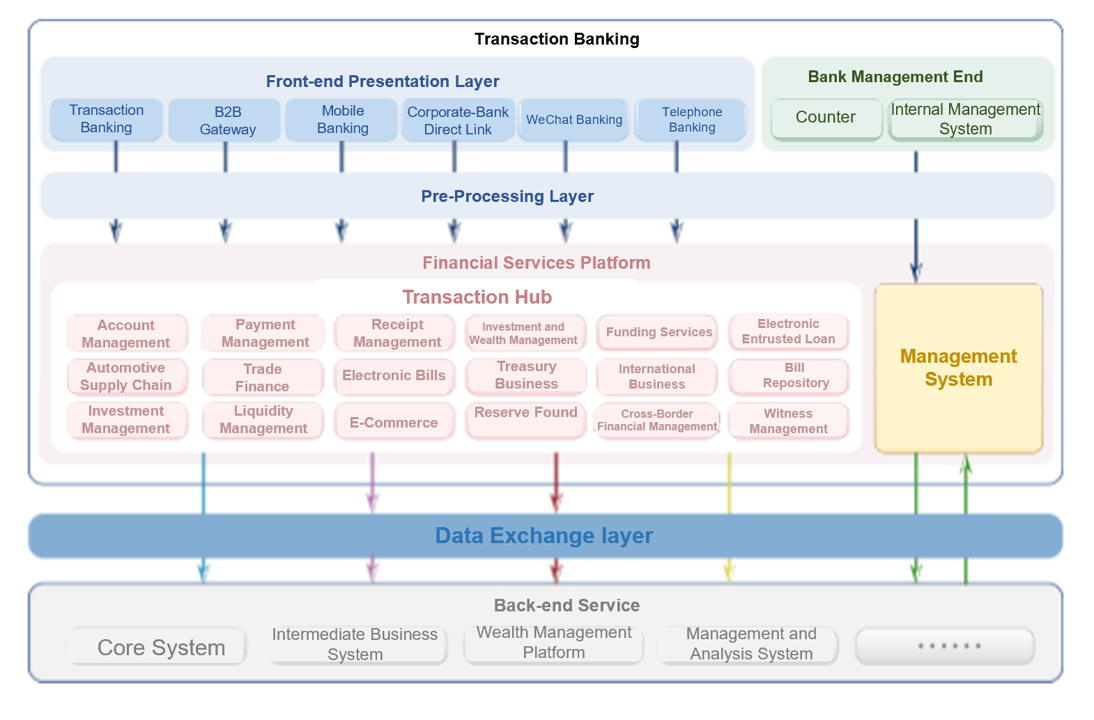

The Transaction Banking System employs strategies of "integration," "sharing," "interconnectivity," "openness," and "user experience" to build a next-generation corporate electronic financial service platform. By standardizing various marketable products across electronic channels and adopting a platform-based approach, it supports the transformation and future development of corporate electronic channels for banks. This system integrates four key platforms—trading, marketing, service, and interaction—into a comprehensive electronic banking solution. It delivers a brand-new experience and comprehensive services to bank clients, while further reducing service costs and enhancing the overall profitability of electronic banking.

?| Product Features

Customer-centricity is at the core of our offering to banks. The system is planned and designed from the client’s perspective, reflecting a strategic focus on "customer-first" principles. It ensures globally consistent customer information, omnidirectional customer service, comprehensive customer marketing, centralized customer data processing, and continuous analysis of customer behavior. This enables bank clients to conduct business efficiently and respond swiftly to market demands.

Two Core Principles:

1. Centralization

Application servers, business data, and process controls are fully centralized.

2. Layering

Achieves separation between technology and business layers, as well as between channel access and business processing.

Four Fundamental Guidelines:

● Simplicity

Focuses on simple design, user-friendly operation, and straightforward management.

● Comprehensiveness

Covers the entire lifecycle of the system, including development, deployment, and management.

● Evolutionability

Allows gradual improvement and adaptation alongside technological advancements and changing needs.

● Scalability

The platform is open, compatible, easily integrable, and highly flexible.