Construct a blockchain-based domestic Letter of Credit business information transmission (sharing) system. By establishing a consortium chain for inter-bank non-standard business information interaction, it replaces the existing method of manual messaging plus SWIFT transmission, achieving secure, efficient sharing and supervision of domestic Letter of Credit business.

A domestic Letter of Credit is a payment and settlement method applicable to domestic trade. It is a written commitment issued by the issuing bank to the beneficiary (seller) at the request of the applicant (buyer), promising to pay a certain amount within a certain period upon presentation of the documents stipulated in the Letter of Credit.

1. Buyer's Letter of Credit business, including modifications and all other related processes, as well as document-related transactions such as receipt of documents and acceptance derived from the buyer's L/C, and associated financing business.

2. Seller's Letter of Credit business covers processes such as L/C notification and modifications, as well as document-related transactions like presentation and dispatch of documents derived from the seller's L/C, and associated financing business.

Forfeiting under domestic L/C refers to a financing bank purchasing an unmatured receivable from the seller on a non-recourse basis after receiving a true and valid confirmation of payment at maturity from the issuing bank under a domestic Letter of Credit settlement.

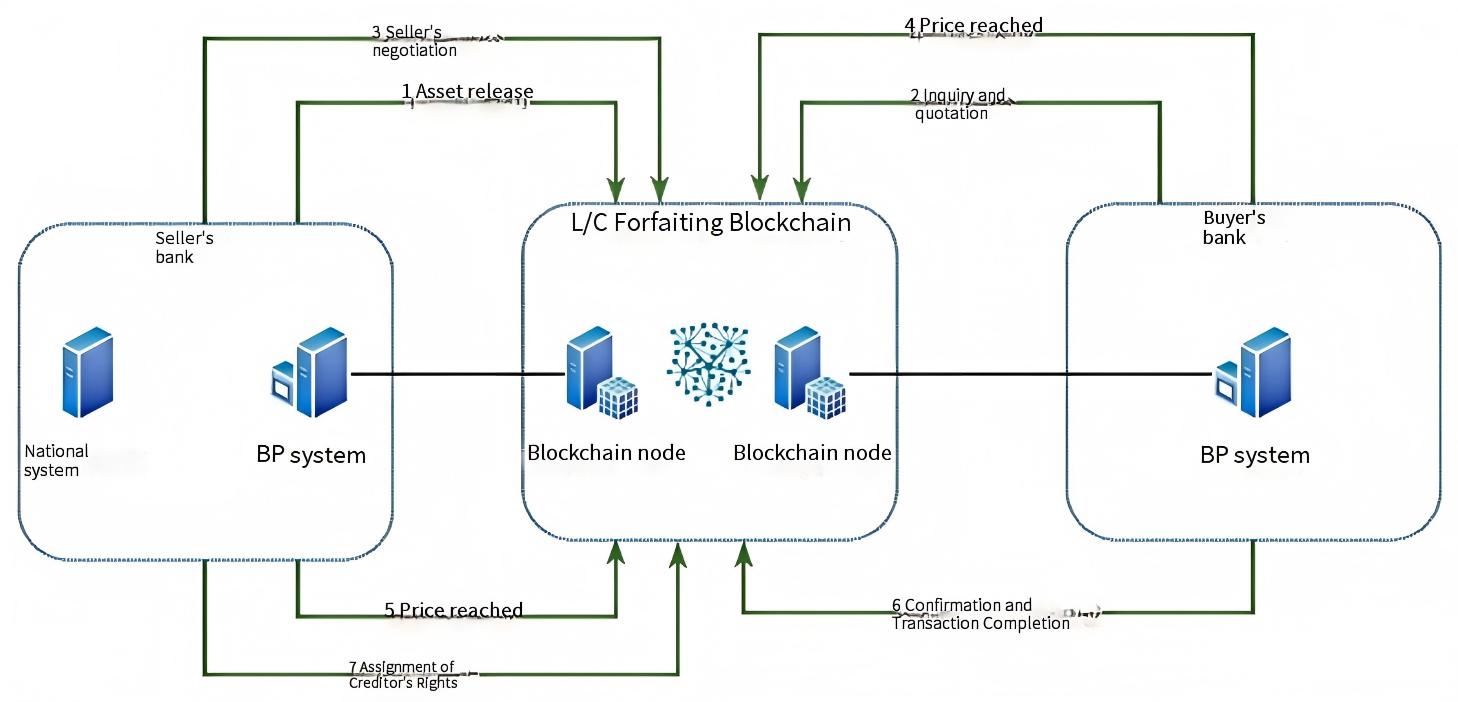

The system uses blockchain to enable inter-bank forfeiting functions such as inquiry, quotation, matching, and receivable transfer, replacing traditional manual methods like phone calls or WeChat. This ensures that the entire transaction process is automatically interfaced, secure, reliable, and clearly traceable.

The "Blockchain Forfeiting Transaction Platform" adopts a consortium chain model, jointly promoted by multiple banks based on current industry-standard business processes. It embodies the principles of equality, mutual trust, and transparency. The platform independently developed blockchain application layer functions based on inter-bank transaction scenarios and created a unique Business Point management end. This effectively and conveniently links the multi-level organizational management structure of banks and provides application service flows that are tailored for forfeiting business. These flows support multiple concurrent scenarios (pre-inquiry, post-asset-release inquiry, fund quotation) while maintaining a logical serial order, thereby ensuring the system's compatibility, interoperability, flexibility, and scalability.

The successful launch of the "Blockchain Forfeiting Transaction Platform" is an effective integration of FinTech productivity and real bank business needs. It will reshape the inter-bank asset transaction process, significantly improve the efficiency and security of asset transactions, and ultimately optimize the customer experience and better support the development of the real economy. By leveraging technologies such as blockchain and big data, it effectively solves the long-standing problems of traditional inter-bank asset transactions, including distorted transaction information through conventional information release channels, the disconnection between price matching and asset transfer, inconsistent multi-party transaction standards, and the cumbersome workload and high information security requirements for operators.