| Product Overview

To promote and standardize the healthy development of Letter of Credit business, implement the central government's requirements for financial services to the real economy and strengthening financial risk prevention and control, and help solve the financing difficulties and high costs for private enterprises, the People's Bank of China officially launched the construction of a unified domestic electronic Letter of Credit information exchange system in July 2019, which officially went live in December 2019.

| Core Advantages

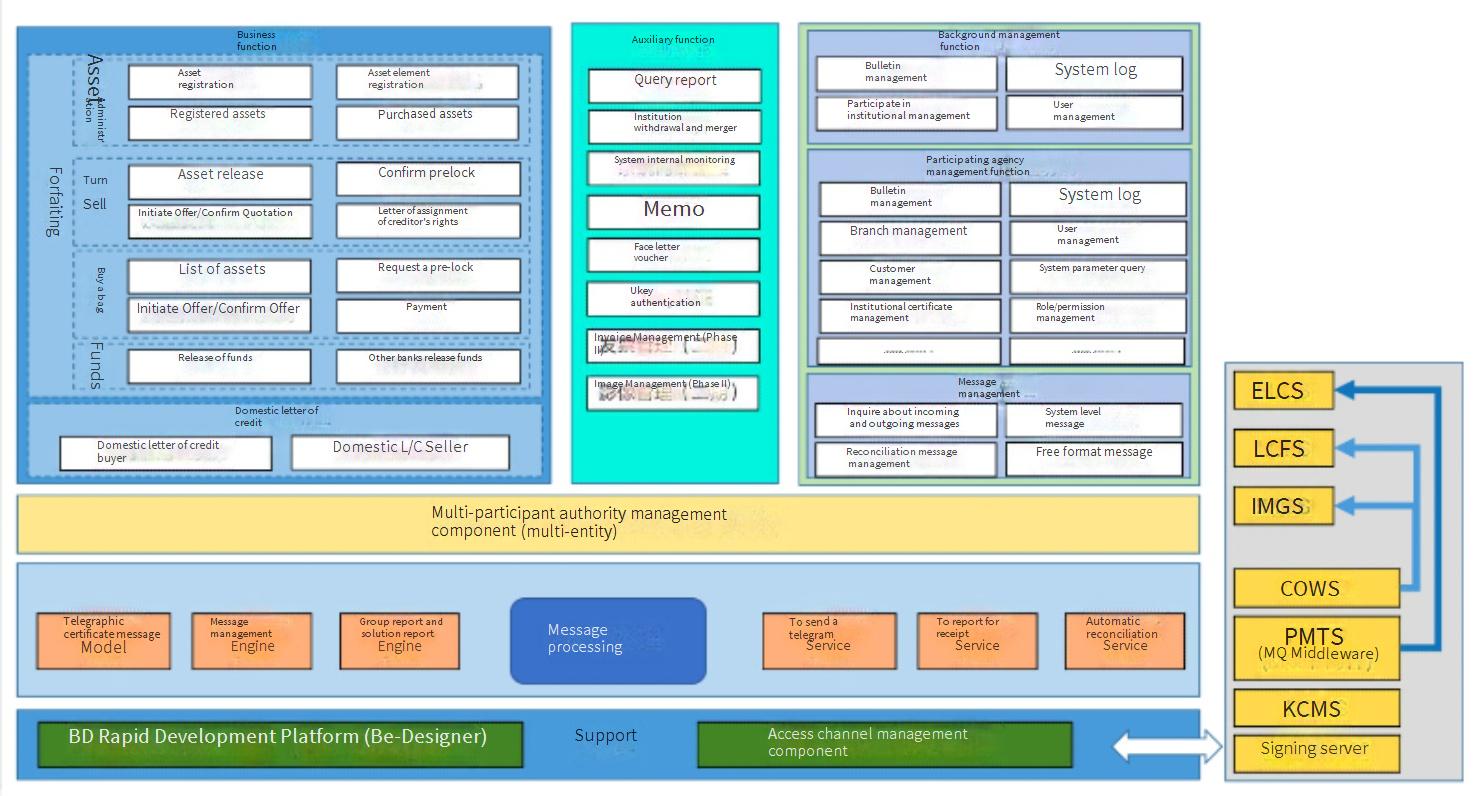

Brilliance Technology, in active response to policies, thorough research of client needs, and leveraging over a decade of rich experience in domestic and international settlement, has independently developed nine major functional modules for the Electronic Letter of Credit System:

1. Basic Business Functions Buyer's L/C, seller's L/C, buyer's payment financing, packing loan, negotiation financing, discounting, and forfeiting (online matching and reselling).

2. Document Center Multiple document centers, task assignment, and various centralized collection modes.

3. Multi-channels ELCS (PBoC Electronic L/C Exchange System), LCFS (Forfeiting Information Exchange Sub-system), HVPS (High Value Payment System), CBAS (Payment System Blockchain Unified Access Service System), CCMS (Common Control and Management System).

4. Static Data Maintenance Maintenance of institutions, tellers, clients, accounts, subjects, fees, and interest rates.

5. Public Affairs Processing Financial, cover letter, reports, reconciliation, regulatory reporting, etc.

6. Image Processing Upload, retrieval, etc.

7. Enterprise Information Network Verification Invoice information verification, invoice uploading, duplicate financing inquiry for invoices, etc.

8. Automation Services Automated rule configuration, automated processes, and automatic clearing of incoming and outgoing messages.

9. Inquiry and Monitoring Business inquiry and statistics, abnormal situation monitoring, etc.

To cooperate with the People's Bank of China's e-L/C front-end, Brilliance Technology has specially developed the e-L/C front-end system to interface with the PBoC front-end, enabling message management, receipt management, message query and statistics, message monitoring, parameter management, status management, reconciliation management, and system management.

| Product Features

The Brilliance’s Electronic Letter of Credit System is characterized by business digitization, standardization and easy configuration, and secure and supervisable operations:

1. Business Digitization With the digitization of the L/C business, all L/Cs must be opened and circulated through the electronic L/C system. Business information is uniformly uploaded to the electronic L/C system. Electronic L/Cs, as the foundational data of financial infrastructure, provide better services for financial support to the real economy.

2. Standardized and Easy to Configure The Brilliance’s Electronic Letter of Credit System complies with industry standards and norms, supports multi-channel access, and can standardize interfaces with business systems, regulatory systems, and the People's Bank of China's electronic L/C system through full configuration.

3. Secure and Supervisable The Brilliance’s Electronic Letter of Credit System will solve long-standing problems that have constrained business development, such as inconsistent domestic L/C business standards, inconvenient inter-bank circulation, and the separation of business processing and fund clearing. It provides a unified online business platform and a one-stop information platform for services like fund clearing for small and medium-sized enterprises and banks.