| Product Overview

Brilliance Technology's Cross-Border Settlement & Trade Finance System is a comprehensive, sophisticated, and robust application platform designed to meet the evolving operational and regulatory demands of modern financial institutions. This system automates end-to-end cross-border settlement and trade finance operations, significantly enhancing operational efficiency while mitigating risk and reducing costs.

| Detailed Description

The system is built upon a mature technological foundation, incorporating Brilliance's deep domain expertise in international finance and decades of implementation experience within the banking sector.

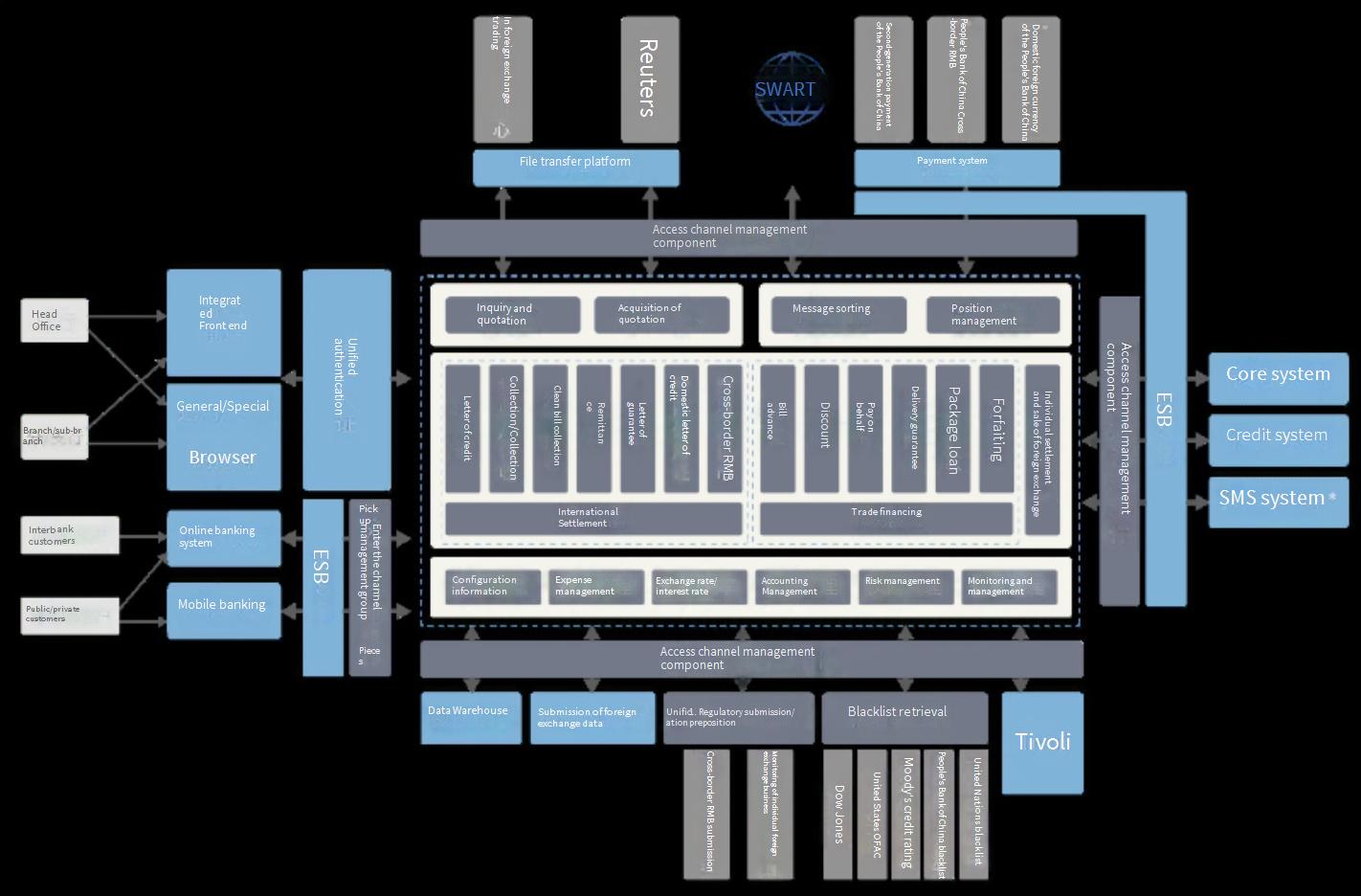

It provides complete functional coverage for cross-border settlement, trade finance, domestic specialized services (with Chinese characteristics), and interbank agency business. The platform features FedNow/SWIFT-certified integration, supporting automated message routing, clearing, transmission, forwarding, and validation.

Architecturally flexible, the system supports centralized, decentralized, or hybrid deployment models. It accommodates diverse operational approaches including head office processing, branch-level processing, and centralized documentary processing. The system facilitates effective association between document imaging data and transactional data, ensures secure storage of electronic documents, and provides highly configurable printing capabilities for vouchers, documents, and messages. Advanced reporting tools enable flexible generation of regulatory and management reports.

The platform offers standardized interfaces for regulatory compliance with requirements from the People's Bank of China (PBOC) including Cross-Border RMB Payment System (CIPS) connectivity, and the State Administration of Foreign Exchange (SAFE) covering foreign exchange settlement reporting, foreign debt registration, capital account monitoring, and financial assets/liabilities reporting. These interfaces support automated data extraction, validation, consistency verification, and automated submission and feedback reception.

| Key Advantages

● Comprehensive Product Suite: Complete coverage of cross-border settlement and trade finance instruments and processes.

● Configurable Business Rules: Flexible parameterization enables rapid implementation of business functions and product variations.

● Multi-Dimensional Risk Control Framework: Sophisticated controls including multi-layered limits management, user profile restrictions, functional permissions, and dual approval workflows. Enhanced by comprehensive audit trails and detailed system logging.

● User-Centric Operational Design: Intuitive interface with contextual help and process guidance reduces training requirements and accelerates user adoption.

● Integrated Development Environment:Embedded rapid development platform supports quick adaptation to new business requirements and market opportunities.

● Future-Proof Architecture: Service-oriented design separates business logic from technical implementation, extending system lifecycle and protecting technology investments.

● Domestic Market Capabilities:Full support for domestic specialized services including domestic letters of credit, domestic guarantees, cross-border RMB operations, and onshore foreign currency services.

● Regulatory Compliance Assurance: Comprehensive reporting capabilities for cross-border RMB payments, foreign exchange settlement reporting, foreign debt reporting, capital account monitoring, and international investment position (IIP) reporting, ensuring full compliance with PBOC, SAFE, and CBIRC regulations.