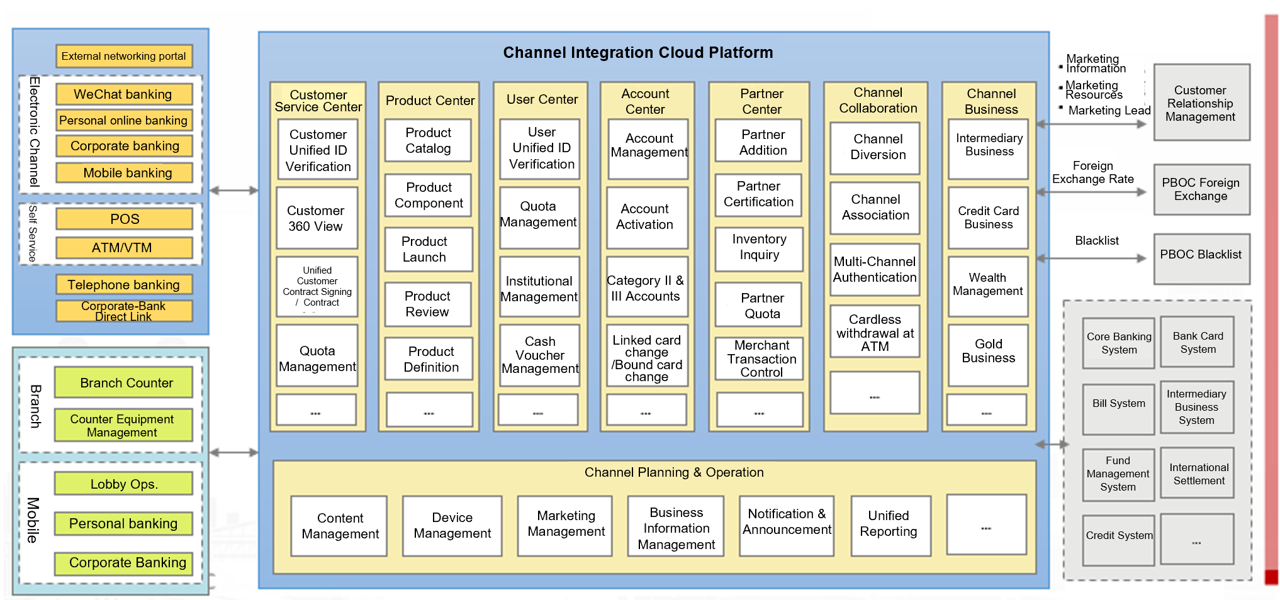

Brilliance Technology has pioneered a revolutionary distributed microservices-based middle-end system for financial institutions - the Channel Integration Cloud Platform. This cutting-edge solution redefines omnichannel banking architecture through its advanced technological framework.

| ?Core Architecture?

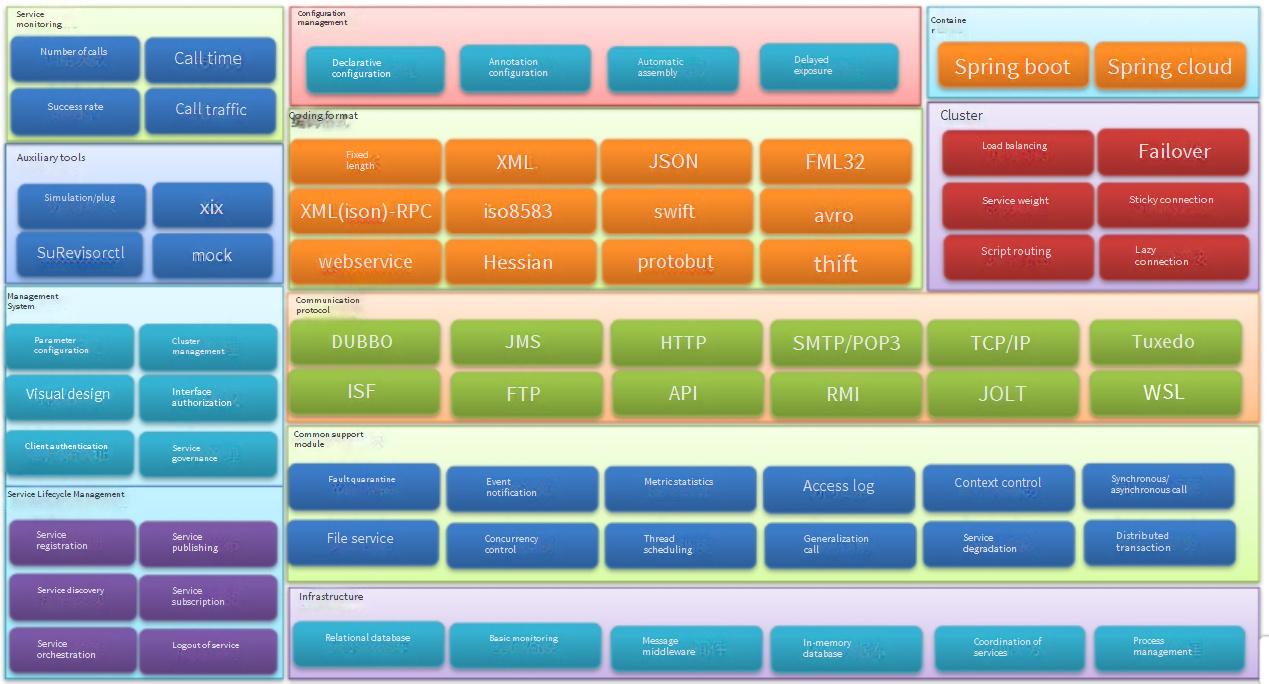

The platform's distributed infrastructure incorporates three fundamental components: distributed database middleware for elastic data processing, high-performance messaging middleware for real-time communication, and in-memory database solutions for accelerated transaction speeds. Its service governance layer features a centralized service registry for dynamic discovery, an operations management console for system monitoring, and an integration development environment for rapid service deployment.

?| Unified Channel Management?

At its core, the platform establishes standardized data protocols and service specifications across all banking touchpoints. By consolidating traditional counters, self-service terminals, and digital channels into a unified backend system, it achieves:

● Centralized transaction routing with intelligent data distribution

● Enterprise-grade security through unified authentication protocols

● Consistent customer experiences across all service channels

The solution eliminates technical fragmentation by abstracting communication protocol differences (including TCP/IP, MQ, and WebService) and message format variations (supporting ISO8583, JSON, SWIFT, etc.), allowing financial institutions to focus on business innovation rather than technical integration challenges.

?| Technical Superiority?

1?. Protocol Agnostic Architecture?: The platform's advanced protocol conversion engine supports 15+ financial message formats, reducing integration workload by 60% compared to traditional approaches.

2. Distributed Resilience?: Utilizing multi-process design and intelligent load balancing algorithms, the system achieves 99.99% availability while optimizing hardware resource utilization.

3?. Development Acceleration Tools?: Unique simulation testing capabilities address the common challenge of asynchronous system development timelines, enabling parallel testing cycles.

4?. Future-Proof Scalability?: The cloud-native architecture supports seamless capacity expansion to accommodate business growth from SME to enterprise-scale operations.

| ?Industry Impact?

Positioned as the central nervous system for digital banking transformation, the platform enables:

● 40% faster new product rollout through "develop once, deploy everywhere" capability

● 35% reduction in channel maintenance costs

● Real-time 360° customer view across all touchpoints

● Gradual modernization of legacy systems without disruptive replacement

This comprehensive solution represents Brilliance Technology's commitment to empowering financial institutions with the technological foundation for next-generation banking services.